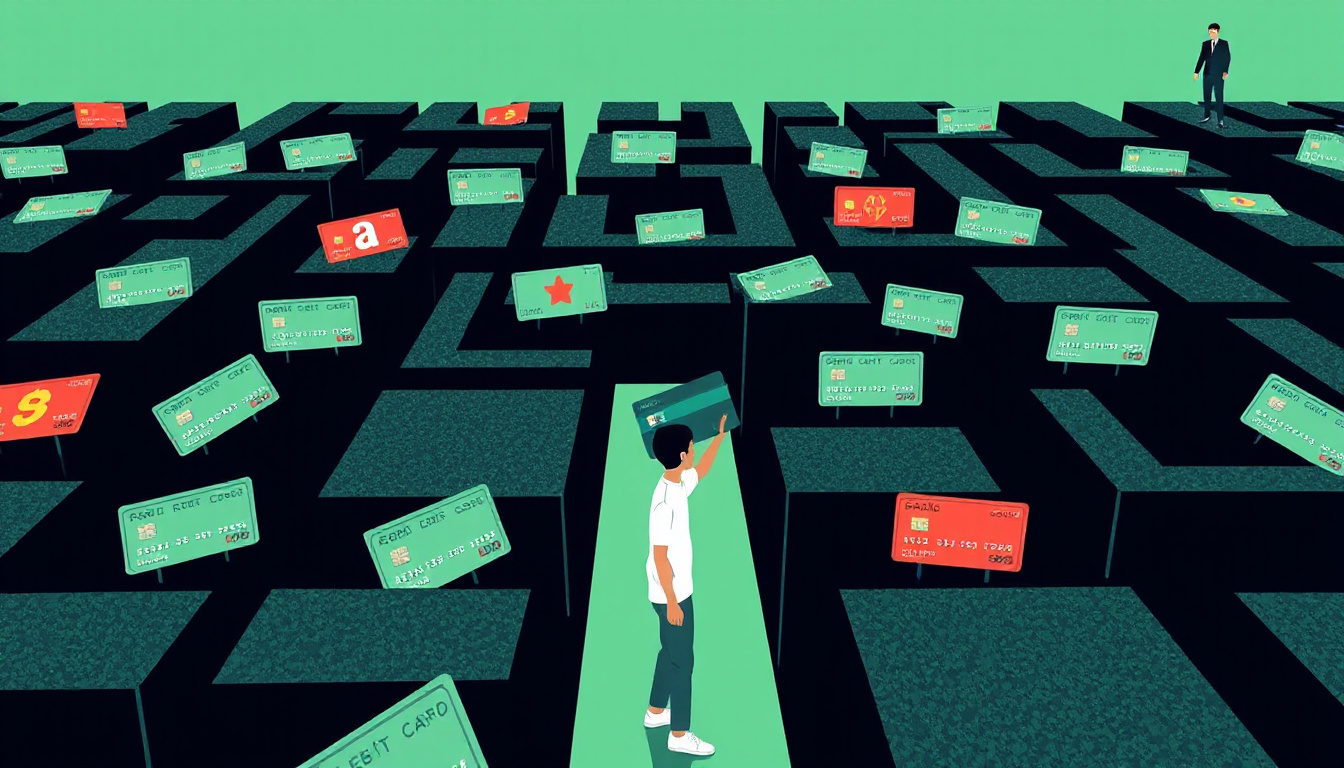

Rewards credit cards have gained immense popularity among Canadian consumers, offering a way to earn benefits on everyday purchases. But how do rewards credit cards work, and how can you leverage them for maximum benefits? This guide delves into the intricacies of rewards systems, the different types of rewards credit cards available, tips for smart usage, and common pitfalls to avoid. By understanding these elements, Canadians can make informed decisions and optimize their credit card rewards to enhance their financial well-being.

Key Takeaways

- Rewards credit cards offer various benefits such as cash back, travel rewards, and points for purchases.

- Understanding the different types of rewards systems can help you choose the best card for your needs.

- To maximize rewards, use your card for everyday purchases and pay off the balance each month.

- Be aware of common pitfalls like high interest rates and annual fees that can offset your rewards.

- Regularly review your rewards program to ensure you’re getting the best value for your spending habits.

Understanding Rewards Systems: Types of Rewards Credit Cards

Rewards credit cards are a popular choice among Canadians looking to maximize their spending power and receive benefits in return. But how do rewards credit cards work? Essentially, they allow cardholders to earn points, cash back, or travel rewards for every dollar spent on eligible purchases. There are several types of rewards systems available, catering to different spending habits and preferences. For instance, cash back cards provide a percentage of the amount spent back to the cardholder, usually in the form of a statement credit or direct deposit. Travel rewards cards, on the other hand, let consumers gather points that can be redeemed for flights, hotel stays, or travel experiences. Points-based systems add another layer, allowing users to accumulate points that can be exchanged for various merchandise or gift cards. In Canada, understanding the intricacies of these rewards systems can help consumers choose the right card to fit their lifestyle and shopping habits, providing added value on everyday purchases.

Maximizing Rewards: Tips for Smart Usage

Rewards credit cards are a popular choice among Canadians looking to maximize their spending power and earn benefits on everyday purchases. Understanding how rewards credit cards work is key to leveraging their full potential. First, they typically offer points, cash back, or travel rewards for every dollar spent, helping you earn valuable benefits while making regular purchases. To maximize rewards, consider the following tips: choose a card that aligns with your spending habits, such as one that offers higher points on groceries or gas; always aim to pay your balance in full each month to avoid interest charges that could negate the rewards earned; and regularly review your rewards program to stay updated on promotions or bonus offers. Additionally, utilizing your rewards strategically—like redeeming points during travel promotions or using cash back for purchases you’d make anyway—can significantly enhance the value you receive from your credit card.

‘The more you know about your tools and how to use them, the more successful you will be in your endeavors.’ – Unknown

Common Pitfalls: What to Avoid with Rewards Credit Cards

Rewards credit cards can offer enticing benefits, but navigating their complexities requires understanding some common pitfalls. First, many Canadians wonder, ‘How do rewards credit cards work?’ These cards earn you points, cashback, or other perks based on your spending. However, one major mistake is failing to pay off the balance in full each month. Carrying a balance incurs high-interest charges that can quickly negate any rewards earned. Additionally, it’s crucial to be mindful of the card’s fees; some rewards cards come with annual fees that may outweigh the benefits if you don’t spend enough to cover them. Another common issue is not aligning your rewards strategy with your spending habits. For instance, if you’re not a frequent traveller, a card that offers travel rewards might not provide maximum value for you. Lastly, failing to keep track of expiration dates on points or cashback can lead to missed opportunities. By being aware of these pitfalls, you can better utilize rewards credit cards and enhance your overall financial strategy.